Looking for more information about Related Organizations Principles & Medicare Cost Report Best Practices? BESLER’s Reimbursement Manager Andrew Kinnaman answers your questions from the recent webinar.

Looking for more information about Related Organizations Principles & Medicare Cost Report Best Practices? BESLER’s Reimbursement Manager Andrew Kinnaman answers your questions from the recent webinar.

To watch Andrew’s Related Organizations Principles & Medicare Cost Report Best Practices Webinar, click HERE.

-

- It sounds like if there is only one hospital and a parent company providing corporate support services to that one hospital, then that parent company would be an A-8-1 related org, not a “home office” requiring separate home office forms. Am I following that correctly?

PRM 15-2, Chapter 48, Section 4800 states, “For Medicare and/or Medicaid purposes, CMS defines a home office as an entity that provides centralized management and administrative services to the individual members of a chain organization and a chain organization as an entity that consists of a group of two or more Medicare-certified providers (providers) or at least one provider and any other non-provider business or entity owned, leased, or through any other device, under common ownership or control. The HO/CO may also include regional offices or divisions.”

- We have a related organization, and costs are brought in via A-8-1. But part of the related costs are salaries. Is there a way to bring in salary costs through A-8-1? Or are all costs treated as non-salary?

There is no cost report mechanism via the WS A-8-1 to identify costs as either salary or non-salary. But you would still identify them on WS S-3 Pt II for Wage Index purposes.

- Are we able to submit an electronic signature for the HO 2023 cost report now?

Electronic signature will be required for all home office costs statements filed after cost report beginning on or after 10/01/2022. CMS requires that the HO/CO submit the home office cost statement, and any regional home office cost statements, in an electronic format (see §4800.20) to the designated contractor no later than 150 days after the end of the HO/CO accounting period. The HO/CO may elect to electronically submit the home office cost statement certification statement with an electronic signature of the home office’s administrator or chief financial officer (see §4801.12). Submission methods for the home office cost statement include sending files to the contractor through the Medicare Cost Report e-Filing (MCReF) portal [URL: https://mcref.cms.gov] or on a CD or flash drive (see §4800.22).

- Medicaid only facilities cannot go on section i.

Medicaid only facilities can still acquire a CCN from Medicare. If you have no or low utilization, you may not have to file a Medicare Cost Report. We would need more information to guide you properly.

- Also, the MAC#s that are correct per CMS listings are causing level II errors.

At this time, we do not have a fix for this. We have run into this issue as well.

- Is there any difference between private/public HO/CO and government-owned HO/CO?

Home Office Allocations – From the FFY 2019 IPPS Final Regulation.

“A chain organization consists of a group of two or more health care facilities which are owned, leased, or through any other device, controlled by one organization (Provider Reimbursement Manual 1 (PRM-1), CMS Pub. 15-1, Chapter 21, Section 2150). Chain organizations include, but are not limited to, chains operated by proprietary organizations and chains operated by various religious, charitable, and governmental organizations. A chain organization may also include business organizations which are engaged in other activities not directly related to health care. You will still need to complete a Form 287 if the government owned HO/CO is allocating expenses to a healthcare facility. - Is there any source for better definitions for the type of related organizations (Codes A through G, etc.)? The cost report instructions provide no help.

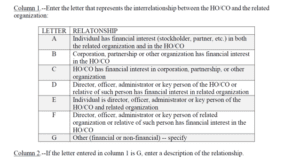

I have not seen any more concise definitions than those provided in the cost report instructions. PRM 15-2, Chapter 48, Section 4802.102 provides only a sentence description for each of the applicable letters defining the interrelationship.

- Are Home Offices considered providers subject to the rules of the PRM- 15-1?

Yes, to the extent that the home office is reporting reasonable and allowable costs that would have been allowed if the provider were to incur the expense. PRM 15-2, Chapter 48, Section 4800.10 states, “A HO/CO must follow the Medicare principles of reasonable cost reimbursement in the Provider Reimbursement Manual, Part I (CMS Pub. 15-1), when completing the Medicare home office cost statement.” The instructions continue additional clarification in 4800.11, “HO/CO costs directly related to services performed for a provider and related to patient care, plus an appropriate share of indirect costs (e.g., overhead, rent for HO/CO space, administrative salaries), are allowable to the extent the costs are reasonable. Any HO/CO costs that are not allowable costs when incurred directly by the provider are not allowable as HO/CO costs allocated to providers.”

- What happens with costs that are incurred at the home office but never get allocated to the COs? Can those costs still be claimed by the COs, or do they have to remain in the home office?

They would remain in the home office if the costs are not related to patient care of the related facility.

- If a cost center has an A-8-1 adjustment, but also an A-8, for something such as non patient revenue, what is the sequence so as not to duplicate the offset? Would you prorate the A-8 to incorporate an A-8_1 adjustment?

If the non-patient revenue being eliminated is related to the related organization, I would eliminate on WS A-8 of 287-22.

- If a hospital obtains services from another member of a chain, in addition to services from the Home Office, how would they address that on the A-8-1?

Typically, the services from the Home Office are required to be reported through the home office cost statement, CMS 287. If the services are from another facility that is part of the chain, the costs are considered related organization. Both the HO/CO expense and the related organization costs are subject to actual cost of the service provided.

- Per wage index, what if you have some super org doing all your billing, IT and med records. They bill you for all these services. Shouldn’t we be able to get their individual employee salaries and hours, not a roll up?

This should be handled as any other contract labor. You should be able to get salaries and hours from the organization just like for legal expenses, consultants, accounting firms, etc.

- You gave an A-6 example with rent. Can’t you use the A81 to do the reclass? Have everything in A&G and add it all back per A81 to the correct Medicare lines?

Yes, in what I would describe in an indirect methodology to assigned costs to their most appropriate grouping. For example, a facility has a corporate assessment that is booked to a corporate account grouped to WS A, Line 5. That corporate assessment may have various type of expense rolled into a single account including possible capital and non-capital costs. One way to approach the reporting of costs is to separately identify the corporate assessment based on expense category and use an WS A-6 to perform the reclassification to the proper WS A cost report line (i.e., capital costs, linen services, medical records, etc.). On WS A-8-1, the GL corporate assessment would be reported based on the WS A-6 reclassification grouping on column 5. The home office costs should identify the actual costs that should be reported with the corresponding reclassified costs from column 5 to amounts on column 4 of WS A-8-1. A second option would be to report all the corporate costs in the GL on a specific line number on WS A-8-1, column 5 and then report on column 4 the actual cost based on type of cost to the appropriate line number, such as, capital to line 1 or 2, linen to line 8, or medical records to line 16. In essence, this reporting methodology would net the column 4 & 5 as possible increase and decreases but would provide for the appropriate grouping of the costs. In this example, WS A-8-1 line 5, Col. 5 might by $10,000,000. The home office expense reported on Col. 4 identified capital costs of $3,000,000 to line 1, non-capital A&G expense of 5,000,000 to line 5, linen expense to line 8 of $1,000,000 and medical record expense to line 16 of$1,000,000. Therefore on the cost report there would be a $5,000,000 adjustment to line 5 ($10,000,000 – $5,000,000), while the other cost centers would now reflect an increase of expense of $3,000,000 and $2,000,000 each.

- Any help in signing up our Home Office in MCRef is greatly appreciated.

The references in the slide presentation Page 50 provide the necessary resources to assist with the set-up and utilization of the Medicare Cost Report Electronic Filing (MCRef). Please reach out to BESLER if you have specific questions or require additional assistance.

- Do you have to start a brand new form, or can you transfer 287-05 over to 287-22 in HFS?

In November of 2023, HFS provided a seminar on the new 287-22. I would suggest contacting them for information that could appropriately answer your question.

- It sounds like if there is only one hospital and a parent company providing corporate support services to that one hospital, then that parent company would be an A-8-1 related org, not a “home office” requiring separate home office forms. Am I following that correctly?

Related Resources

- WEBINAR: Related Organizations Principles & Medicare Cost Report Best Practices Webinar (recording and slides)

- Related Organizations Principles & Medicare Cost Report Best Practices Webinar [PODCAST]